UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant☒

Filed by a Party other than the Registrant☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to |

TEGNA Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| May 12, 2022 |

Dear Fellow Shareholders:

Howard D. Elias |

David T. Lougee |

• • $1.4 billion record advertising • $948 million Adjusted EBITDA, • 40% year-over-year growth in • 22.2% free cash flow as a • $3.3 billion in total debt and net

| ||||

As we reflect on the past year, we could not be more proud of TEGNA’s talented and dedicated team which enabled us to achieve strong performance in 2021. We continued to execute well across the board, delivering solid financial results, and enhancing the value of our portfolio of leading broadcast stations and innovative digital brands. We also made good progress on our environmental, social, and governance efforts, including our commitment to fostering a diverse, equitable, and inclusive culture.

MARCH 12, 2018TEGNA journalists continued to be integral to the fabric of our communities and deliver trusted local news and media content across our wide audience base and multiple platforms. We fought misinformation and disinformation through the expansion of VERIFY into a standalone national brand, helping our audiences distinguish between true and false information. Through our acquisition of Locked On Podcast Network, we strategically expanded our local sports offerings in the rapidly growing podcast market and on YouTube.

Dear Shareholder:We also made great strides in accelerating the pace of racial diversity and inclusion across our company. In 2021, TEGNA achieved double-digit growth in Black, Indigenous and People of Color (BIPOC) representation in content teams, content leadership, and company leadership during the year. We are tracking above the rate of change needed to achieve the quantifiable 2025 DE&I goals that we established in 2021. We also completed diversity and inclusion training and content audits across all 49 of our newsrooms as part of the Inclusive Journalism program we developed with The Poynter Institute.

As responsible stewards of our resources, we enhanced oversight, reporting, and accountability of our commitment to minimize our carbon footprint and preserve the environment. In 2021, we completed a comprehensive greenhouse gas (GHG) emissions inventory that included our scope 1 and 2 GHG emissions from our direct operations, as well as relevant indirect scope 3 GHG emissions across our value chain to inform our long-term environmental goals and action plans.

On behalfFebruary 22, 2022, we announced with Standard General L.P. (“Standard General”) that TEGNA, an affiliate of yourStandard General, and certain other parties have entered into a definitive agreement under which TEGNA will be acquired by the Standard General affiliate. The transaction, which is expected to close in the second half of 2022, follows the Board’s thorough review of acquisition proposals received by the Company and an evaluation of this opportunity against TEGNA’s standalone prospects and other strategic alternatives. The transaction was unanimously approved by the TEGNA Board, of Directors and management, we cordially invitewhich believes it maximizes value for TEGNA shareholders.

As a TEGNA shareholder, you will have the opportunity to attendvote on the Annualtransaction at a Special Meeting of ShareholdersStockholders to be held on April 26, 2018 at 10:00 a.m. ET atMay 17, 2022.

We would like to express our sincere gratitude to our TEGNA colleagues for their demonstrated commitment over the Company’s headquarters located at 7950 Jones Branch Drive, McLean, Virginia 22107.

At this meeting,last year to helping us achieve outstanding results and fulfilling our shareholders will vote on matters set forth in the accompanying Notice of Annual Meeting and Proxy Statement. We also will provide a report on our Company, including an update on the Company’s performance as we approach theone-year anniversary of thespin-off of Cars.com, and entertain questions of general interest to shareholders.

2017 was a truly transformative year for our Company—by spinning off Cars.com and concluding our evaluation of strategic alternatives for CareerBuilder by selling a majority ownership interest to a group led by investment funds managed by affiliates of Apollo Global Management, LLC and the Ontario Teachers’ Pension Plan Board, we completed our transformation into a pure-play media company focused on being abest-in-class operator, transforming our content, sales and marketing offerings and generating strong cash flow.

At TEGNA, we continue to deliver highly relevant content and information to consumers across all platforms. As always, our foundation remains our long-standing commitment to provide outstanding journalism across our stationspurpose to serve the greater good of our communities.

We are proud of the successful efforts made byalso want to take this opportunity to thank our approximately 5,300 employees in driving TEGNA’s continuing transformation, finding new ways to engage audiences in today’s multi-platform environment and enhancing our alignment with the evolving needs of consumers, advertisers and marketers.

Thank youshareholders for your support and continued support.

Cordially,interest in our company. We look forward to TEGNA building on its many successes in its next chapter.

|  | |

Howard D. Elias

|

| |

|

President and Chief Executive Officer |

7950 Jones Branch Drive, McLean, Virginia 22107(703) 873-6600

|

Notice of Annual Meeting of Shareholders

To Our Shareholders:

The

|

MEETING INFORMATION

DATE:

TIME:

LOCATION:

| |||

|

Company’s Board of Directors to hold office until the Company’s Meeting of Shareholders; | |||

|

firm for the | |||

| to consider and act upon a Company proposal to approve, on an advisory basis, the compensation of our named executive officers; | |||

| to consider and act upon a shareholder proposal regarding the shareholder right to call a special meeting; and | |

| to transact such other business, if any, as may properly come before the Annual Meeting or any adjournment or postponement of the meeting. |

Your Board of Directors unanimously recommends that you vote FOR all eleven nominees listed on the enclosed proxy card or voting instruction form, FOR proposals 2 and 3, and AGAINST proposal 4.

We have enclosed the annual report, proxy statement (together with the notice of Annual Meeting), and proxy card or voting instruction form. For specific instructions on how to vote your shares, please refer to the instructions on the proxy card or voting instruction form to vote by Internet, telephone, or by mail. We encourage shareholders to submit their proxies electronically – by telephone or by Internet – whenever possible.

The Board of Directors has set the close of business on February 26, 2018May 3, 2022 as the record date to determine the shareholders entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

An admission ticket is required for attendance at the Annual Meeting. Please see page 67 of the Proxy Statement for instructions about obtaining tickets.

By Action of the Board of Directors,

Akin S. Harrison

Senior Vice President, Associate General Counsel and Secretary

McLean,Tysons, Virginia

MarchMay 12, 20182022

| Notice of Annual Meeting of Shareholders |

Your Vote Is Important. YourPlease vote by proxy TODAY to ensure that your shares should beare represented at the annual meetingAnnual Meeting whether or not you currently plan to attend. You do not need to attend the meeting to vote if you vote your shares before the meeting. If you do not wish to vote in person or if you will not be attending the annual meeting,are a record holder, you may vote by proxy. Shareholders of record can vote by proxy over the internet or by telephone by following the instructions provided in the notice of internet availability of proxy materials that was previously mailed to you or, if you requested printed copies of the proxy materials, you can also voteyour shares by mail, by telephone or on the internet as instructed onInternet. If you later decide to attend the meeting, your vote will revoke any proxy card you received.previously submitted. If your shares are held in an account atby a brokerage firm,broker, bank broker-dealer or other similar organization, pleasenominee, you must follow the instructions provided by your broker, bank or other nominee to vote your shares and you may not vote your shares by ballot at the meeting unless you provide a “legal proxy” from the broker, bank or other nominee that organization. You may revokeholds your shares giving you the right to vote the shares at the meeting. Please review “Questions and Answers about the Proxy Materials and the Annual Meeting” beginning on page 76 of the Proxy Statement for information about attending and voting at the Annual Meeting.

Due to the potential public health impact of the coronavirus (COVID-19) and to support the well-being of our employees and stockholders, we will hold the Annual Meeting virtually online via a live webcast at meetnow.global/MVM6R56. To participate in the Annual Meeting, you must enter the 16 digit control number included in your proxy and vote in person if you decidecard or voting instruction form. Online access to the Annual Meeting will open approximately 15 minutes prior to the start of the Annual Meeting. You will not be able to attend the annual meeting.Annual Meeting in person at a physical location. For purposes of attendance at the Annual Meeting, all references in this proxy statement to “present” shall mean virtually present at the Annual Meeting.

| INTERNET | TELEPHONE | ONLINE | ||||

|

|

|

| |||

Access the website indicated on the enclosed proxy card or voting instruction form. | Call the number indicated on the enclosed proxy card or voting instruction form. | Sign, date and return the enclosedproxy card or voting instruction form in the postage-paid envelope provided. | Attend the virtual meeting via live webcast at meetnow.global/MVM6R56 and vote by ballot online. | |||

TEGNA INTENDS TO HOLD A SPECIAL MEETING OF SHAREHOLDERS ON MAY 17, 2022 TO APPROVE THE PREVIOUSLY ANNOUNCED AGREEMENT AND PLAN OF MERGER DATED FEBRUARY 22, 2022, AS AMENDED BY AMENDMENT NO. 1 ON MARCH 10, 2022 (AS MAY BE FURTHER AMENDED OR SUPPLEMENTED, THE “MERGER AGREEMENT”) BY AND AMONG TEGNA, TETON PARENT CORP., A NEWLY FORMED DELAWARE CORPORATION (“PARENT”), TETON MERGER CORP., A NEWLY FORMED DELAWARE CORPORATION AND AN INDIRECT WHOLLY OWNED SUBSIDIARY OF PARENT, AND SOLELY FOR PURPOSES OF CERTAIN PROVISIONS SPECIFIED THEREIN, OTHER SUBSIDIARIES OF PARENT, CERTAIN AFFILIATES OF STANDARD GENERAL L.P., A DELAWARE LIMITED PARTNERSHIP AND CMG MEDIA CORPORATION, A DELAWARE CORPORATION, AND CERTAIN OF ITS SUBSIDIARIES. NO ACTION WILL BE TAKEN AT THE ANNUAL MEETING WITH RESPECT TO, AND NO PROXY IS BEING SOLICITED HEREBY IN CONNECTION WITH, THE MERGER AGREEMENT OR ANY MATTERS RELATED THERETO.

This Notice of Annual Meeting and Proxy Statement is first being delivered to shareholders on or about May 12, 2022.

|

| PROPOSAL 3 – APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | ||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

This Notice of Annual Meeting and Proxy Statement are first being delivered to shareholders on or about March 12, 2018.

|

|

2017: A Year of Transformation

2017 was aTEGNA Inc.

This summary highlights information about TEGNA Inc. (“TEGNA” or the “Company”) and the upcoming 2022 annual meeting of shareholders (the “Annual Meeting”). Please review the complete Proxy Statement and TEGNA’s annual report for the fiscal year of continued transformationended December 31, 2021 (the “2021 Annual Report”) before you vote. The Proxy Statement and progress for our Company. We completed previously announced strategic actions thatthe 2021 Annual Report will drive the Company forward and we continuedfirst be mailed or released to evolve to meet the constantly changing needs of our consumers, clients and customers. We also launched new, innovative products, and told impactful, meaningful stories that made a difference to the communities that we serve. In every decision we made, we positioned our Company for success, now and in the future.shareholders on or about May 12, 2022.

We successfully completed thespin-off of Cars.com (the “Cars.comSpin-off”) and sold our controlling interest in CareerBuilder, completing our transformation into a pure-play media company. We remain confident that these actions will maximize long-term value for our shareholders while putting the Company in the best position to succeed for its customers and its employees.

Our Company

ANNUAL MEETING OF SHAREHOLDERS

• Time and Date: • Record Date: • Admission: | 9:00 a.m. ET on June 21, 2022 May 3, 2022 You are entitled to attend the Annual Meeting if you were a TEGNA shareholder as of the close of business on the record date. If you plan to attend the meeting, you must register in advance by following the procedures described in “Questions and Answers about the Proxy Materials and the Annual Meeting” beginning on page 76 and abide by the agenda and procedures for the Annual Meeting (which will be available on the virtual Annual Meeting site). If your shares are held by a broker, bank or other holder of record in “street name” (including shares held in certain TEGNA employee benefit plans), you must also provide proof of your ownership of the shares as of the record date in order to attend the meeting. See “Questions and Answers About the Proxy Materials and Annual Meeting – What must I do if I want to attend the Annual Meeting?” on page 77 of this Proxy Statement for additional information and instructions. |

| 2022 PROXY STATEMENT | | i |

| 2022 Proxy Statement Summary: Performance Highlights |

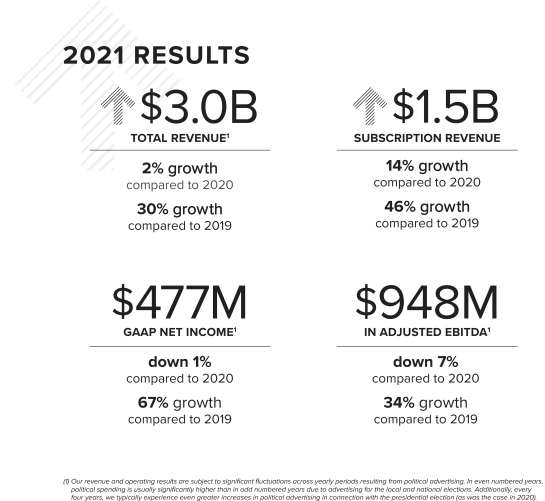

Performance Highlights

TEGNA achieved strongrecord financial results in 2017. Our overall2021, creating substantial value for shareholders, and is well positioned for growth into the future.

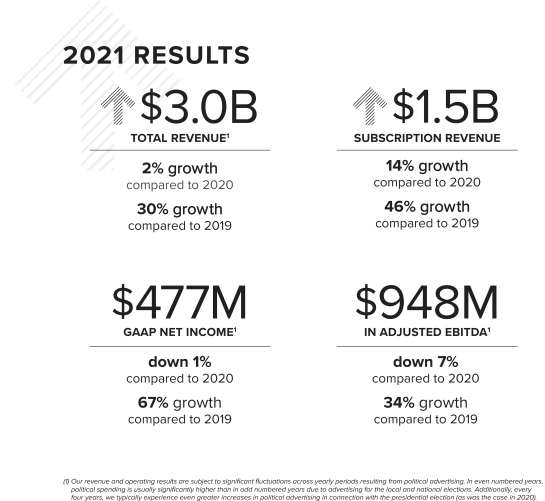

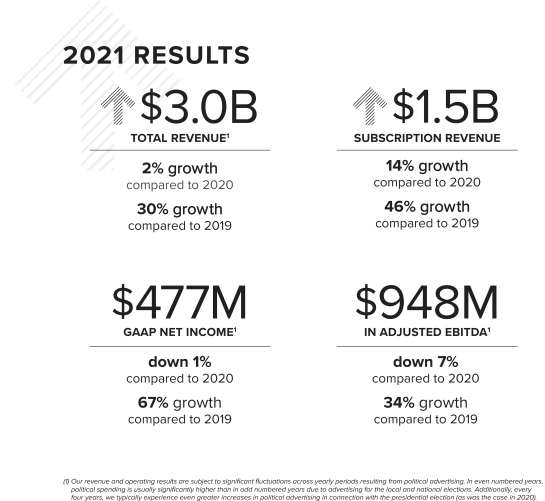

Highlights of our 2021 performance included:

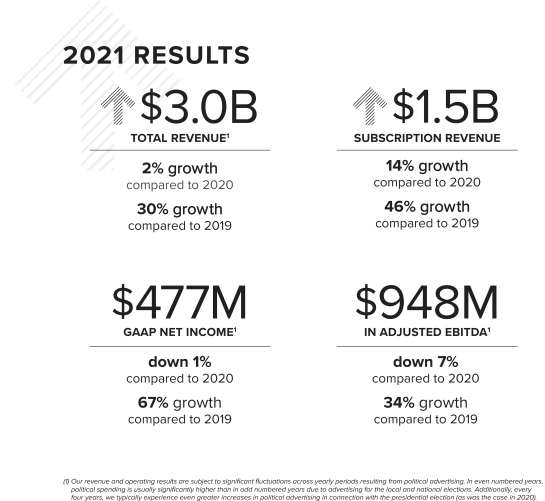

Total revenues. Total company revenue was $1.9$3.0 billion, growing sevenup two percent year-over-year and up 30% on a two-year basis.

Record AMS revenues. The company generated record advertising revenue of $1.4 billion, up 22 percent year-over-year.

Record subscription revenue growth. We achieved record subscription revenue of $1.5 billion, up 14 percent year-over-year (partially offset by subscriber declines and the interruption of service with DISH).

GAAP net income. Our GAAP net income was $477 million.

Adjusted EBITDA. Company Adjusted EBITDA totaled $948 million (representing net income attributable to TEGNA before net income attributable to redeemable noncontrolling interest, income taxes, interest expense, equity (loss), other non-operating items, special items, depreciation and amortization), a record for an odd-year, and was up 34 percent on atwo-year basis.

Premion revenue growth. Premion achieved more than 40 percent growth in 2021 relative to 2020 despite the absence of political revenue and the ongoing weakness in the auto category due to supply chain issues.

Reconciliations of the following non-GAAP comparable basis.* Our adjusted EBITDA* totaled $631.4 million, with anfinancial measures to the Company’s results as reported under accounting principles generally accepted in the United States may be found in the Company’s Form 10-K, filed March 1, 2022: adjusted EBITDA margin– page 35.

| ii | | 2022 PROXY STATEMENT |

| 2022 Proxy Statement Summary: Voting Matters and Board Recommendations |

Voting Matters and Board Recommendations

Voting Matter | Voting Standard | Board Vote | See | |||||

| Proposal 1 | Election of Directors | To be elected, a director nominee must receive more votes “for” than votes “against” with respect to the nominee. | FOR ALL NOMINEES | 1 | ||||

| Proposal 2 | Ratification of Appointment of Independent Registered Public Accounting Firm | Majority of the votes that could be cast by the shareholders present or represented by proxy. | FOR | 25 | ||||

| Proposal 3 | Approval, on an Advisory Basis, of the Compensation of our Named Executive Officers | Majority of the votes that could be cast by the shareholders present or represented by proxy. | FOR | 64 | ||||

| Proposal 4 | Shareholder Proposal – Shareholder Right to Call a Special Shareholder Meeting | Majority of the votes that could be cast by the shareholders present or represented by proxy. | AGAINST | 65 | ||||

| 2022 PROXY STATEMENT | | iii |

| 2022 Proxy Statement Summary: Snapshot of 2022 Director Nominees |

Snapshot of 33 percent. In addition, our innovation initiatives contributed an even-increasing percentage2022 Director Nominees

Director Nominees

The Board of our revenue, marking strong success in execution.Directors has nominated the director candidates below. All director nominees have stated that they are willing to serve if elected. Personal information about each director nominee is available beginning on page 2 of this Proxy Statement.

We

Name & Principal Occupation

| Age

| Director

| Diversity1 Identifier

| Status

| Committee Memberships

| |||||

Gina L. Bianchini Founder and CEO, Mighty Networks | 49 | 2018 | W | Independent | Nominating and Governance; Public Policy and Regulation | |||||

Howard D. Elias Chair of TEGNA; President, Services and Digital, Dell Technologies | 64 | 2008 | W | Independent | Executive (Chair); Leadership Development and Compensation | |||||

Stuart J. Epstein Chief Financial Officer, DAZN Group | 59 | 2018 | W | Independent | Audit (financial expert) | |||||

Lidia Fonseca EVP and Chief Digital and Technology Officer, Pfizer Inc. | 53 | 2014 | L | Independent | Audit; Leadership Development and Compensation | |||||

Karen H. Grimes Retired Partner, Senior Managing Director and Equity Portfolio Manager, Wellington Management Company | 66 | 2020 | W | Independent | Audit (financial expert); Nominating and Governance | |||||

David T. Lougee President and CEO, TEGNA Inc. | 63 | 2017 | W | Executive | Executive | |||||

Scott K. McCune Founder, MS&E Ventures; Former Vice President of Global Media and Integrated Marketing, The Coca-Cola Company | 65 | 2008 | W | Independent | Audit; Executive; Leadership Development and Compensation (Chair) | |||||

Henry W. McGee Senior Lecturer, Harvard Business School; Former President, HBO Home Entertainment | 69 | 2015 | B | Independent | Executive; Nominating and Governance (Chair); Public Policy and Regulation | |||||

Bruce P. Nolop Retired CFO, E*Trade Financial Corporation | 71 | 2015 | W | Independent | Audit (financial expert) (Chair); Executive | |||||

Neal Shapiro President and CEO, public television company WNET | 64 | 2007 | W | Independent | Nominating and Governance; Public Policy and Regulation | |||||

Melinda C. Witmer Founder, Foiye, Inc.; Former Executive Vice President, Chief Video & Content Officer; Time Warner Cable | 60 | 2017 | W | Independent | Leadership Development and Compensation; Public Policy and Regulation | |||||

| 1 | B – Black or African American; L – Latino; W – White or Caucasian. |

| iv | | 2022 PROXY STATEMENT |

| 2022 Proxy Statement Summary: Information About Directors |

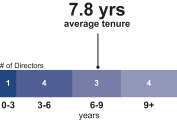

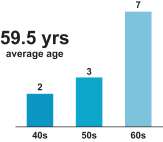

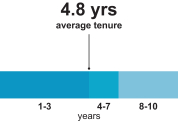

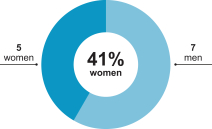

Information About Directors

Our Board members have a diverse set of qualifications, skills and experiences and also are very pleased to have ended 2017 on a high note, announcing our acquisition from Midwest Television, Inc.reflect diversity of television broadcast stations,KFMB-TV, the CBS affiliated station,age, tenure, gender andKFMB-D2 (CW), and radio broadcast stations, KFMB 760 AM talk radio andKFMB-FM, each in San Diego, which we completed in February 2018.

In 2017, we commenced a board refreshment process race/ethnicity. The Board regularly evaluates its composition to ensure that the skills and experience of ourthe directors remain aligned with our evolving business. This resulted inas a whole enhance the addition of three new directors:

On February 22, 2018, we also announced that Howard D. Elias would succeed Marjorie Magner asnon-executive chairmanability of the Board immediately followingto provide independent oversight of management as they execute on strategic initiatives to create sustainable stockholder value.

Since 2017, the Annual Meeting.Company has undergone a Board refreshment process to ensure our directors’ expertise aligns with TEGNA’s strategic evolution. During this period, we added four independent directors with deep expertise in media, technology, social/digital, and capital markets and transactional experience, supplementing the existing skills and experience of our Board.

| Gender Diversity | Racial & Ethnic Diversity | |

|

| |

| Age | Tenure | |

|  | |

| 2022 PROXY STATEMENT | | v |

| 2022 Proxy Statement Summary: Information About Directors |

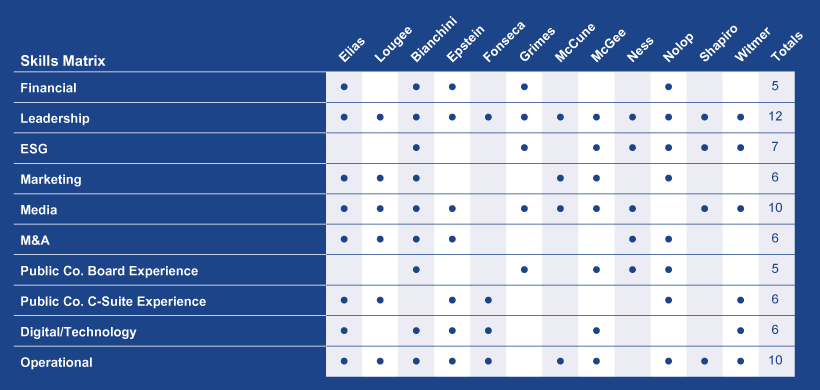

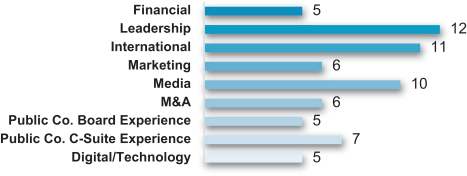

Director Skills Matrix

See the director nominee biographies beginning on Page 2 of this Proxy Statement for further detail. The absence of a “●” for a particular skill does not mean that the director does not possess that qualification, skill, or experience. We look to each director to be knowledgeable in these areas; however, the mark indicates that the item is a particularly prominent qualification, skill or experience that the director brings to the Board.

| vi | | 2022 PROXY STATEMENT |

| 2022 Proxy Statement Summary: Corporate Governance Highlights |

Corporate Governance Highlights

Board and Governance Practices u 11 of 12 directors are independent u Board gender diversity – 5 female directors (42% of Board) u All Standing Board Committees are fully independent: Audit, Leadership Development and Compensation, Nominating and Governance, Public Policy and Regulation u Independent Board Chair enhances oversight of management u All directors stand for election annually u One-vote-per-share capital structure with all shareholders entitled to vote for director nominees u Majority voting standard for uncontested director elections with a director resignation policy u No shareholder rights plan (poison pill) in place u Annual review by the Board of TEGNA’s major risks with certain oversight delegated to Board committees u Clear CEO and executive officer succession plan Board Refreshment and Evaluation u Ongoing board refreshment process that has resulted in our Board adding 4 independent directors since 2017, the transition of the

u Annual board performance evaluation | Social Responsibility Practices u Public Policy and Regulation Committee provides independent oversight of sustainability, environmental matters and social responsibility u Enhanced reporting of environmental, social and governance (“ESG”) disclosures, including disclosure under the SASB Media and Entertainment framework u Completed comprehensive greenhouse gas (GHG) emissions inventory that included scope 1 and 2 GHG emissions from our direct operations, as well as relevant indirect scope 3 GHG emissions across our value chain u Focus on diversity and inclusion initiatives u Each Board committee has separate areas of oversight regarding the Company’s u We have established and continue to make progress against our multi-year goals to increase Black, Indigenous and People of Color representation in content teams, news leadership and management roles Executive Compensation Practices u A significant percentage of the compensation we provide to our NEOs is performance-based. u Maximum annual bonus payouts and performance share payouts are capped at 200% of target. | u Compensation recoupment (“clawback”) policy covering restatements and misconduct applicable to all current and former executive officers u Hedging and pledging of TEGNA securities by TEGNA employees and directors is prohibited u All new change-in-control arrangements are “double trigger” Shareholder Engagement u TEGNA maintains a long-standing shareholder engagement program, involving year-round active dialogue and the participation of its independent directors; shareholder feedback is shared with the full Board u In early 2021, the Company actively reached out to shareholders representing, in the u Several changes implemented in response to feedback gathered during shareholder engagement in recent years, including adoption of proxy access, changes to executive compensation program and enhancements to ESG reporting Director Engagement u 16 full Board meetings in 2021; overall attendance at all of the

u Directors prohibited from serving on more than 3 other public company boards |

| 2022 PROXY STATEMENT | | vii |

|

Proposal 1—Election of Directors

(Proposal 1 on the proxy card)

YOUR BOARD OF DIRECTORSYour Board of Directors

The Board of Directors is currently composed of twelve directors, including the eleven directors nominated forre-election reelection and Marjorie Magner, our current Chairman,Susan Ness, who is retiring from the Boardnot standing for reelection at the 20182022 Annual Meeting in order to devote more time to philanthropic activities.because she has reached the Company’s mandatory retirement age for non-management directors. The Board of Directors held twelvesixteen meetings during 2017.2021. Each director attended at least 94%92% of the meetings of the Board and its committees on which he or she served that were held during the period for which he or she served as a director or committee member, as applicable, during 2017.2021. All directors then serving on the Board virtually attended the 20172021 Annual Meeting in accordance with the Company’s policy that all directors attend the Annual Meeting.Meeting

Nominees elected to our Board at the 20182022 Annual Meeting will serveone-year terms expiring at the Company’s 20192023 Annual Meeting of Shareholders. The Board, upon the recommendation of its Nominating and Public ResponsibilityGovernance Committee, has nominated the following individuals: Gina L. Bianchini, Howard D. Elias, Stuart J. Epstein, Lidia Fonseca, Karen H. Grimes, David T. Lougee, Scott K. McCune, Henry W. McGee, Susan Ness, Bruce P. Nolop, Neal Shapiro and Melinda C. Witmer. The Board believes that each of the nominees will be available and able to serve as a director. Each of the nominees has consented to being named in this Proxy Statement and to serve on the Board, if elected. If any nominee becomes unable or unwilling to serve, the Board may do one of three things: recommend a substitute nominee, reduce the number of directors to eliminate the vacancy, or fill the vacancy later. The shares represented by all valid proxies may be voted for the election of a substitute if one is nominated.

The Under the Company’sBy-laws, the provide that2022 director nominees arewill be elected by the vote of a majority of the votes cast with respect to the director at the meeting, unless the number of nominees exceeds the number of directors to be elected, in which case directors shall be elected by the vote of a plurality of the shares present and entitled to vote at the meeting. At the 2018 Annual Meeting, the majority vote standard will apply. If an incumbent nominee does not receive an affirmative majority of the votes cast, he or she is required to submit a

|

|

PROPOSAL 1—ELECTION OF DIRECTORS

Your Board of Directors

letter of resignation to the Board’s Nominating and Public ResponsibilityGovernance Committee, which would recommend to the Board the action to be taken with respect to the letter of resignation. The Board is required to act on the Committee’s recommendation and publicly disclose its decision and its rationale within 90 days after the election results are certified.

Our Board regularly reviews the Company’s Board leadership structure, how the structure is functioning and whether the structure continues to be in the best interest of Directors unanimously recommends that you vote “FOR” the election of each of the nominees to serve as directors of the Company until the Company’s 2019 Annual Meeting and until their successors are elected and qualified.

our shareholders. Our Board has determined that having an independent director serve as the ChairmanChair of the Board is currently the best leadership structure for the Company. Separating the positions of ChairmanChair and CEO allows the CEO to focus on executing the Company’s strategic plan and managing the Company’s operations and performance and permits improved communications between the Board, the CEO and other senior leaders of the Company. Our Board regularly reviews the Company’s Board leadership structure, how the structure is functioning and whether the structure continues to be in the best interest of our shareholders.

The duties of the ChairmanChair of the Board include:

presiding over all meetings of the Board and all executive sessions ofnon-management directors;

serving as liaison on Board-wide issues between the CEO and thenon-management directors, although Company policy also provides that all directors shall have direct and complete access to the CEO at any time as they deem necessary or appropriate, and vice versa;

in consultation with the CEO, reviewing and approving Board meeting schedules, agendas and materials;

being available when appropriate for consultation and direct communication if requested by shareholders.

THE BOARD’S ROLE IN RISK OVERSIGHT

Evaluating how senior leadership identifies, assesses, manages and monitors the various risks confronting the Company is one of the most important areas of the Board’s oversight. In carrying out this critical responsibility, the Board oversees the Company’s risk management function through regular discussions with senior leadership, considering the Company’s risks in the context of the Company’s strategic plan and operations. In doing so, the Board actively and regularly reviews, guides and oversees the implementation of the Company’s long-term strategic plan. In addition, the Company has an enterprise risk management program to enhance the Board’s and management’s ability to identify, assess, manage and respond to strategic, market, operational and compliance risks facing the Company.

While the Board has primary responsibility for overseeing the Company’s risk management function, each committee of the Board also considers risk within its area of responsibility. For example, the Executive Compensation Committee reviews risks relating to compensation matters. The Board is apprised by the committee chairs of significant risks and management’s response to those risks via periodic reports. While the Board and its committees oversee the Company’s risk management function, management is responsible for implementingday-to-day risk management processes and reporting to the Board and its committees on such matters.

The Audit Committee is primarily responsible for reviewing risks relating to accounting and financial controls. In addition, the Board has designated the Audit Committee with primary responsibility for overseeing the Company’s enterprise risk management program. In accordance with this responsibility, the Audit Committee monitors the Company’s significant business risks, including financial, operational, privacy, cybersecurity, business continuity, legal and regulatory, and reputational exposures, and reviews the steps management has taken to monitor and control these exposures. With respect to cybersecurity, the Board receives regular reports from Company management, including updates on the internal and external cybersecurity threat landscape, incident response, assessment and training activities, and relevant legislative, regulatory, and technical developments.

With respect to risks relating to compensation matters, the Executive Compensation Committee with the assistance of its independent compensation consultant has reviewed the Company’s executive compensation program and has concluded that the program does not

| | | 1

|

PROPOSAL 1—ELECTION OF DIRECTORS

The Board’s Role in Risk Oversight

create risks that are reasonably likely to have a material adverse effect on the Company. The Executive Compensation Committee views the design of the Company’s annual cash and long-term equity incentives as providing an effective and appropriate mix of incentives to help ensure the Company’s performance is focused on long-term profitability and shareholder value creation and does not encourage unnecessary or excessive risk taking at the expense of long-term results.

The Board of Directors has determined that, other than David T. Lougee, all of our current directors are, and other than Gracia C. Martore, former President and CEO of the Company, all directors who served during the Company’s most recently completed fiscal year were, “independent” of the Company within the meaning of the rules governing NYSE-listed companies. For a director to be “independent” under NYSE rules, the Board of Directors must affirmatively determine that the director has no material relationship with the Company, either directly or as a partner, shareholder, or officer of an organization that has a relationship with the Company. To assist it in making these determinations, the Board has determined that the following categories of relationships between a director and the Company are not material:

In making its independence determinations, our Board considered all relationships, direct and indirect, between each director and our Company that were identified in questionnaires completed by each Board member.

Consistent with the NYSE rules, the Company’s Principles of Corporate Governance call for the Company’snon-management directors to meet in regularly scheduled executive sessions without management as they deem appropriate. The Company’snon-management directors held five executive sessions in 2017, and will meet in executive sessions as appropriate throughout 2018.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION; RELATED TRANSACTIONS

Our Company has not had compensation committee interlocks with any other company, nor has our Company engaged in any material related transactions since January 1, 2017, the first day of our last fiscal year. Although no such related transactions have occurred or are anticipated, the Board will consider any other future transactions involving the Company, on the one hand, and any of its officers or directors, on the other hand, on acase-by-case basis, and any such approved transaction involving a director will be considered in assessing his or her independence.

The Company has adopted a related person transaction policy that outlines the procedures that directors not involved in the transaction will follow in connection with reviewing certain transactions involving the Company and related persons. The policy takes into account the categories of transactions that the Board has determined are not material in making determinations regarding independence and requires directors and executive officers to notify the Company’s chief legal officer of any potential related person transactions.

|

|

PROPOSAL 1—ELECTION OF DIRECTORS

Corporate Governance

The Board and the Company have instituted strong corporate governance practices, a number of which are described above, to ensure that the Company operates in ways that support the long-term interests of our shareholders. Other important corporate governance practices of the Company include the following:

Additional information regarding the Company’s corporate governance practices is included in the Company’s Principles of Corporate Governance posted on the Corporate Governance page under the “Investors” menu of the Company’s website atwww.tegna.com. See the “Compensation Discussion and Analysis” section of this Proxy Statement for a discussion of the Company’s compensation-related governance practices.

The Company is committed to acting in the best interests of its shareholders, and views ongoing dialogue with shareholders as a critical component of the Company’s corporate governance program. As part of this commitment, the Company actively engages with its shareholders in order to fully understand their viewpoints concerning the Company, to garner feedback on areas for improvement, and to help our shareholders better understand our performance and long-term strategic plan. We believe our regular engagement with shareholders has been productive and provides an open exchange of ideas and perspectives for both the Company and its shareholders.

Company management regularly engages with many of its investors through in person and telephonic meetings throughout the year to solicit input and answer questions on a variety of topics. Company management provides the Board with regular updates regarding its shareholder outreach efforts as well as feedback received from shareholders, which helps to influence our policies and practices.

During 2017 and early in 2018, the Company actively engaged with shareholders, holding an investor day on May 17, 2017 and reaching out to shareholders representing, in the aggregate, more than 50% of our outstanding shares in order to understand their viewpoints concerning a variety of topics, including the following:

|

|

PROPOSAL 1—ELECTION OF DIRECTORS

Shareholder Engagement

The Company also has a policy that all of our directors attend our Annual Meeting of Shareholders, which presents yet another opportunity for us to engage directly with our shareholders. All of the standing directors, and those nominated for election at the time, attended the Company’s 2017 Annual Meeting of Shareholders.

For those who are unable to attend any of our investor meetings, transcripts of all management presentations are available on our website atwww.tegna.com. Any shareholder who has an inquiry or meeting request is invited to contact Jeff Heinz, Vice President/Investor Relations, at703-873-6917.

ANNUAL BOARD PERFORMANCE EVALUATION

The Company believes in continuously improving its corporate governance practices in order to support the Company’s performance. In 2017, the Board retained an independent consultant experienced in corporate governance matters to conduct anin-depth study of the Board’s effectiveness and to assist it with the annual performance evaluation process. The consultant interviewed each director to obtain his or her assessment of the effectiveness of the Board and its committees, including identifying opportunities for the Board to enhance its effectiveness. The Board then met with the consultant to discuss the consultant’s findings and recommendations for enhancing the Board’s overall operation and effectiveness. As a result of this process, the Board implemented a number of the consultant’s recommendations, including increasing the amount of time dedicated to Board strategy discussions and holding more committee meetings in between scheduled Board meetings.

INFORMATION ABOUT DIRECTORSTEGNA Nominees

Our Board members have a diverse set of qualifications, skills and experiences and also reflect diversity of age, tenure and gender. The Board regularly evaluates its composition to determine if there are areas for improvement. Our recent director refreshment activities led the Board to add Ms. Witmer in December 2017 and Ms. Bianchini and Mr. Epstein in February 2018, supplementing the existing skills and experience of our Board, increasing the size of the Board to 12 directors and resulting in 5 of our 11 independent directors having less than 3 years of tenure.

|  |  |

DIRECTOR SKILLS

|

|

PROPOSAL 1—ELECTION OF DIRECTORS

Information About Directors

The Nominees

The following director nominees are currently serving on the Board and have been nominated by the Board on the unanimous recommendation of the Nominating and Public ResponsibilityGovernance Committee to stand forre-election at the Company’s 20182022 Annual Meeting for aone-year term. The principal occupation and business experience of each TEGNA nominee, including the reasons the Board believes each of them should bere-elected to serve another term on the Board, are described below.

The Board of Directors unanimously recommends that the shareholders of the Company vote FOR the election of the nominees to serve as directors.

|

|

|

|

|

|

PROPOSAL 1—ELECTION OF DIRECTORS

Information About Directors

Age: Director since: 2018 |

• Nominating and • Public Policy and

|

Professional Experience:

Ms. Bianchini is Founder and Chief Executive Officer of Mighty Networks, a position she has held since September 2010. She served as Chief Executive Officer of Ning, Inc. from 2004 to March 2010 and Co-founder and President of Harmonic Networks from March 2000 to July 2003. Ms. Bianchini also served as a director of Scripps Networks Interactive, Inc. through 2018.

Qualifications and Strategy-Related Experience:

|

|

|

|

|

2 | | 2022 PROXY STATEMENT |

PROPOSAL 1—ELECTION OF DIRECTORS

Information About Directors

|

|

|

|

|

|

|

|

PROPOSAL 1—ELECTION OF DIRECTORS

Information About Directors

Age: Director since: |

• Executive • Leadership Development and

|

Professional Experience:

Mr. Elias was named the Chair of TEGNA in April 2018 and is President, Services and Digital, of Dell Technologies, a position he has held since September 2016. Prior to that, he served as President and Chief Operating Officer, EMC Global Enterprise Services from January 2013 to September 2016 and was President and Chief Operating Officer, EMC Information Infrastructure and Cloud Services from September 2009 to January 2013. From October 2015 through September 2016, Mr. Elias was also responsible for leading the development of EMC Corporation’s integration plans in connection with its transaction with Dell Inc. Previously, Mr. Elias served as President, EMC Global Services and Resource Management Software Group; Executive Vice President, EMC Corporation from September 2007 to September 2009; and Executive Vice President, Global Marketing and Corporate Development, at EMC Corporation from October 2003 to September 2007.

|

|

Qualifications and Strategy-Related Experience:

|

|

|

Chief Financial Officer, DAZN Group Age: 59 Director since: 2018 | TEGNA Committees: • Audit |

Professional Experience:

Mr. Epstein is Chief Financial Officer of DAZN Group, a position he has held since September 2018. Previously, he was Senior Advisor, Evolution Media, from October 2017 to January 2018. He served as Co-Managing Partner of Evolution Media from September 2015 to September 2017 and Executive Vice President and Chief Financial Officer of NBCUniversal from September 2011 to April 2014. Prior to that, Mr. Epstein held various senior positions during his 23 years at Morgan Stanley, including Managing Director and Global Head of the Media & Communications Group within the investment banking division.

Qualifications and Strategy-Related Experience:

| 2022 PROXY STATEMENT | | | 3 |

| Proposal 1—Election of Directors: Information about the TEGNA Nominees |

| Lidia Fonseca EVP and Chief Digital and Technology Officer, Pfizer Inc. Age: 53 Director since: 2014 | TEGNA Committees: • Audit • Leadership Development and Compensation |

Professional Experience:

Ms. Fonseca is Executive Vice President and Chief Digital and Technology Officer of Pfizer Inc., a position she has held since January 2019. Prior to that she served as Chief Information Officer and Senior Vice President of Quest Diagnostics from April 2014 to December 2018. Previously, Ms. Fonseca served as Chief Information Officer and Senior Vice President of Laboratory Corporation of America (LabCorp) from 2008 to 2013. She was named a Healthcare Transformer by Medical, Marketing & Media in 2019 and in 2017 she received the Forbes CIO Innovation Award recognizing CIOs who lead revenue enhancing innovation efforts.

Qualifications and Strategy-Related Experience:

| Karen H. Grimes Retired Partner, Senior Managing Director and Equity Portfolio Manager, Wellington Management Company Age: 66 Director since: 2020 | TEGNA Committees: • Audit • Nominating and Governance Other Public Company Directorships: • Corteva • Toll Brothers, Inc. |

Professional Experience:

Ms. Grimes held the position of Senior Managing Director, Partner, and Equity Portfolio Manager at Wellington Management Company LLP, an investment management firm, from January 2008 through December 2018. Prior to joining Wellington Management Company in 1995, she held the position of Director of Research and Equity Analyst at Wilmington Trust Company, a financial investment and banking services firm, from 1988 to 1995. Before that, Ms. Grimes was a Portfolio Manager and Equity Analyst at First Atlanta Corporation from 1983 to 1986 and at Butcher and Singer from 1986 to 1988. Ms. Grimes is a member of the Financial Analysts Society of Philadelphia and holds the Chartered Financial Analyst designation.

Qualifications and Strategy-Related Experience:

4 | | 2022 PROXY STATEMENT |

| Proposal 1—Election of Directors: Information about the TEGNA Nominees |

PROPOSAL 1—ELECTION OF DIRECTORS

| David T. Lougee President and CEO,TEGNA Inc. Age: 63 Director since: 2017 | TEGNA Committees: • Executive |

Professional Experience:

Mr. Lougee became President and Chief Executive Officer and a director of TEGNA in June 2017. He previously served as the President of TEGNA Media from July 2007 to May 2017. Prior to joining TEGNA, he served as Executive Vice President, Media Operations for Belo Corp. from 2005 to 2007. Mr. Lougee also serves as a director of Broadcast Music, Inc. and the Broadcasters Foundation of America. Mr. Lougee previously served as chairman of the NBC Affiliates Board. He also is the former joint board chairman of the National Association of Broadcasters (NAB) and past chair of the Television Bureau of Advertising (TVB) Board of Directors.

Qualifications and Strategy-Related Experience:

| Scott K. McCune Founder, MS&E Ventures; Former VP, Global Media and Integrated Marketing, The Coca Cola Company Age: 65 Director since: 2008 | TEGNA Committees: • Audit • Executive • Leadership Development and Compensation (Chair) |

Professional Experience:

Mr. McCune is the Founder of MS&E Ventures, a firm focused on creating new business value for brands through media, sports and entertainment. Prior to his retirement in March 2014, Mr. McCune spent 20 years at The Coca-Cola Company serving in a variety of roles, including Vice President, Global Partnerships & Experiential Marketing from 2011-2014, Vice President Global Media and Integrated Marketing from 2005-2011, and Vice President, Global Media, Sports & Entertainment Marketing and Licensing from 1994-2004. He also spent 10 years at Anheuser-Busch Inc. where he held a variety of positions in marketing and media. Mr. McCune also serves as a director of First Tee of Atlanta and the College Football Hall of Fame.

Qualifications and Strategy-Related Experience:

| 2022 PROXY STATEMENT | | | 5 |

| Proposal 1—Election of Directors: Information about the TEGNA Nominees |

| Henry W. McGee Senior Lecturer, Harvard Business School Age: 69 Director since: 2015 | TEGNA Committees: • Executive • Nominating and Governance (Chair) • Public Policy and Regulation

Other Public Company Directorships: • AmerisourceBergen Corporation |

Professional Experience:

Mr. McGee has been a Senior Lecturer at Harvard Business School since July 2013. Previously, he served as a consultant to HBO Home Entertainment from April 2013 to August 2013 after serving as President of HBO Home Entertainment from 1995 until his retirement in March 2013. Mr. McGee held the position of Senior Vice President, Programming, HBO Video, from 1988 to 1995 and prior to that, Mr. McGee served in leadership positions in various divisions of HBO. Mr. McGee also serves as a director of the Pew Research Center and The Black Filmmaker Foundation. He is also a former President of the Alvin Ailey Dance Theater Foundation and the Film Society of Lincoln Center. He was recognized by Savoy Magazine in 2016 and 2017 as one of the Most Influential Black Corporate Directors and in 2018 the National Association of Corporate Directors named Mr. McGee to the Directorship 100 as one of the country’s most influential boardroom members.

Qualifications and Strategy-Related Experience:

| Bruce P. Nolop Retired CFO, E*Trade Financial Corporation Age: 71 Director since: 2015 | TEGNA Committees: • Audit (Chair) • Executive Other Public Company Directorships: • Marsh & McLennan Companies, Inc. |

Professional Experience:

Mr. Nolop retired in 2011 from E*Trade Financial Corporation, where he served as Executive Vice President and Chief Financial Officer from September 2008 through 2010. Mr. Nolop was Executive Vice President and Chief Financial Officer of Pitney Bowes Inc. from 2000 to 2008 and Managing Director of Wasserstein Perella & Co. from 1993 to 2000. Previously, he held positions with Goldman, Sachs & Co., Kimberly-Clark Corporation and Morgan Stanley & Co. Mr. Nolop also served as a director of On Deck Capital, Inc. through October 2020.

Qualifications and Strategy-Related Experience:

6 | | | 2022 PROXY STATEMENT |

| Proposal 1—Election of Directors: Information about the TEGNA Nominees |

| Neal Shapiro President and CEO, The WNET Group Age: 64 Director since: 2007 | TEGNA Committees: • Nominating and Governance • Public Policy and Regulation |

Professional Experience:

Mr. Shapiro is President and CEO of the public television company WNET which operates three public television stations in the largest market in the country: Thirteen/WNET, WLIW and NJTV. He is an award-winning producer and media executive with a 35-year career spanning print, broadcast, cable and online media. Before joining WNET in February 2007, Mr. Shapiro served in various executive capacities with the National Broadcasting Company beginning in 1993 and was president of NBC News from May 2001 to September 2005. During his career, Mr. Shapiro has won numerous journalism awards, including 32 Emmys, 31 Edward R. Murrow Awards and 3 Columbia DuPont awards. He also serves on the Board of Trustees at Tufts University. Mr. Shapiro also serves as a director of the Institute for Non-profit News.

Qualifications and Strategy-Related Experience:

| Melinda C. Witmer Founder and CEO, Foiye, Inc.; Former Executive Vice President, Chief Video & Content Officer, Time Warner Cable Age: 60 Director since: 2017 | TEGNA Committees: • Leadership Development and Compensation • Public Policy and Regulation |

Experience:

Ms. Witmer is the Founder of LookLeft Media, a startup company focused on the development of new real estate technology and media products, a position she has held since March 2018. Prior to starting LookLeft Media, Ms. Witmer was Executive Vice President, Chief Video & Content Officer of Time Warner Cable, a position she held from January 2012 until May 2016 when Time Warner Cable was acquired by Charter Communications. Prior to that, she served as Time Warner Cable’s Executive Vice President and Chief Programming Officer from January 2007, after holding multiple senior roles with Time Warner Cable beginning in 2001. Prior to joining Time Warner Cable, Ms. Witmer was Vice President and Senior Counsel at Home Box Office, Inc.

Qualifications and Strategy-Related Experience:

| 2022 PROXY STATEMENT | | | 7 |

| Proposal 1—Election of Directors: Committees of the Board of Directors |

Committees of the Board of Directors

COMMITTEES OF THE BOARD OF DIRECTORS

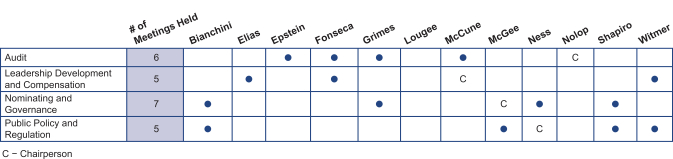

The Board of Directors conducts its business through meetings of the Board and its four standing committees: the Audit Committee, Leadership Development and Compensation Committee, Nominating and Governance Committee and Public Policy and Regulation Committee. The Board also has an Executive Committee Executive Compensation Committee(not shown on the chart below) made up of the Board Chair, the CEO and Nominating and Public Responsibility Committee.each of the Board committee chairs, that may exercise the authority of the Board between meetings, as required. The following chart below shows the current membership and chairperson of each of ourthe standing Board committees and the number of committee meetings held during 2017.

| ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

|

C – Chairperson

The Audit Committee assists the Board of Directors in its oversight of financial reporting practices and the quality and integrity of the financial reports of the Company.2021. Each member of the Audit, Leadership Development and Compensation, Nominating and Governance, and Public Policy and Regulation Committee meets the applicable independence requirements of the SEC as well as those of the NYSE. In addition, the Board has determined that Bruce P. Nolop is an audit committee financial expert, as that term is defined under the SEC rules. This Committee met seven times in 2017.

The Executive Committee may exercise the authority of the Board between Board meetings, except as limited by Delaware law. The Executive Committee did not meet in 2017.

Executive Compensation Committee

The Executive Compensation Committee discharges the Board’s responsibilities relating to the compensation of the Company’s directors and executives and has overall responsibility for the Company’s compensation plans, principles and programs. The Committee’s duties and responsibilities include reviewing and approving on an annual basis corporate goals and objectives relevant to the compensation of the Company’s CEO and other senior executives, including members of the TEGNA Leadership Team and certain other Company officers. The Committee also is responsible for reviewing and discussing with management the Compensation Discussion and Analysis (CD&A) disclosures contained in the Company’s Proxy Statement, and for making a recommendation as to whether the CD&A disclosures should be so included and incorporated by reference into the Company’s Annual Report on Form10-K. The Board of Directors has determined that each member of the Committee meets the independence requirements of the SEC as well as those of the NYSE. This Committee met six times in 2017.

The Committee has primary responsibility for administering the Company’s equity incentive plans and in that role is responsible for approving equity grants to our senior executives. The Committee historically has delegated to the CEO the authority for approving equity grants to employees other than our senior executives mentioned above within the parameters of a pool of shares approved by the Committee. This provides flexibility for equity grants to be made to employees below the senior leadership level who are less familiar to the Committee.

Under its charter, the Committee may, in its sole discretion, retain or obtain the advice of a compensation consultant, independent legal counsel or other adviser. The Committee is directly responsible for the appointment, compensation and oversight of any such consultant, counsel or adviser, and the Company shall provide appropriate funding for payment of reasonable compensation to any such consultant, counsel or adviser, as determined by the Committee. In selecting a consultant, counsel or adviser, the Committee

|

|

PROPOSAL 1—ELECTION OF DIRECTORS

Committees of the Board of Directors

evaluates its independence by considering the following six factors and any other factors the Committee deems relevant to the adviser’s independence from management:

The Committee retains Meridian Compensation Partners, LLC (Meridian) as its consultant to advise it on executive compensation matters. After considering the six factors used by the Committee to evaluate independence, the Committee determined that Meridian is an independent compensation consultant in accordance with applicable SEC and NYSE rules.

Meridian participates in Committee meetings as requested by the chairman of the Committee and communicates directly with the chairman of the Committee outside of meetings. Meridian specifically has provided the following services to the Committee:

Nominating and Public Responsibility Committee

The Nominating and Public Responsibility Committee is charged with identifying individuals qualified to become Board members, recommending to the Board candidates for election orre-election to the Board and considering from time to time the Boardeach committee structure and makeup. The Committee also monitors the Company’s human resources practices, including its performance in diversity and equal employment opportunity, monitors the Company’s performance in meeting its obligations of fairness in internal and external matters, and takes a leadership role with respect to the Company’s corporate governance practices. This Committee met five times in 2017.

The Nominating and Public Responsibility Committee charter sets forth certain criteria for the Committee to consider in evaluating potential director nominees. In addition to evaluating a potential director’s independence, the Committee considers whether director candidates have relevant experience in business and industry, government, education and other areas, and monitors the mix of skills and experience of directors in order to assure that the Board has the necessary breadth and depth to perform its oversight function effectively. The charter also encourages the Committee to work to maintain a board that reflects the diversity of the communities we serve. The Committee evaluates potential candidates against these requirements and objectives. For those director candidates who appear upon first consideration to meet the Committee’s criteria, the Committee will engage in further research to evaluate their candidacy.

The Nominating and Public Responsibility Committee periodically retains search firms to assist in the identification of potential director nominee candidates based on criteria specified by the Committee and in evaluating and pursuing individual candidates at the direction of the Committee. The Committee will also consider timely written suggestions from shareholders. Shareholders wishing to suggest a candidate for director nomination for the 2019 Annual Meeting should mail their suggestions to TEGNA Inc., 7950 Jones Branch Drive, McLean, Virginia 22107, Attn: Secretary. Suggestions must be received by the Secretary of the Company no earlier than December 27, 2018 and no later than January 16, 2019. The manner in which the Committee evaluates director nominee candidates suggested by shareholders will be consistent with the manner in which the Committee evaluates candidates recommended by other sources.

|

|

PROPOSAL 1—ELECTION OF DIRECTORSshe or he serves.

Committees of the Board of Directors

TheBy-laws of the Company establish a mandatory retirement age of 70 for directors who have not been executives of the Company and 65 for directors who have served as executives, except that the Board of Directors may extend the retirement age beyond 65 for directors who are or have been the CEO of the Company. The Company’s Principles of Corporate Governance also provide that a director who retires from, or has a material change in responsibility or position with, the primary entity by which that director was employed at the time of his or her election to the Board of Directors shall offer to submit a letter of resignation to the Nominating and Public Responsibility Committee for its consideration. The Committee will make a recommendation to the Board of Directors on whether to accept or reject the resignation, or whether other action should be taken.

The written charters governing the Audit Committee, the Executive Compensation Committee and the Nominating and Public Responsibility Committee, as well as the Company’s Principles of Corporate Governance, are posted on the Corporate Governance page of the Company’s website atwww.tegna.com under the “Investors” menu. You may also obtain a copy of any of these documents without charge by writing to: TEGNA Inc., 7950 Jones Branch Drive, McLean, Virginia 22107, Attn: Secretary.

The Company has long maintained a code of conduct and ethics (the “Ethics Policy”) that sets forth the Company’s policies and expectations. The Ethics Policy, which applies to every Company director, officer and employee, addresses a number of topics, including conflicts of interest, relationships with others, corporate payments, the appearance of impropriety, disclosure policy, compliance with laws, corporate opportunities and the protection and proper use of the Company’s assets. The Ethics Policy meets the NYSE’s requirements for a code of business conduct and ethics as well as the SEC’s definition of a code of ethics applicable to the Company’s senior officers. Neither the Board of Directors nor any Board committee has ever granted a waiver of the Ethics Policy.

The Ethics Policy is available on the Corporate Governance page of the Company’s website atwww.tegna.com under the “Investors” menu. You may also obtain a copy of the Ethics Policy without charge by writing to: TEGNA Inc., 7950 Jones Branch Drive, McLean, Virginia 22107, Attn: Secretary. Any additions or amendments to the Ethics Policy, and any waivers of the Ethics Policy for executive officers or directors, will be posted on the Corporate Governance page under the “Investors” menu of the Company’s website and similarly provided to you without charge upon written request to this address.

The Company has a telephone hotline staffed by an independent third party for employees and others to submit their concerns regarding violations or suspected violations of the Company’s Ethics Policy or violations of law and for reporting any concerns regarding accounting or auditing matters on a confidential anonymous basis. Employees and others can report concerns by calling1-800-695-1704 or by emailing or writing to the addresses provided in the Company’s Ethics Violation Reporting Policy found on the Corporate Governance page of the Company’s website atwww.tegna.com under the “Investors” menu. Any concerns regarding accounting or auditing matters so reported will be communicated to the Company’s Audit Committee.

The Audit Committee assists the Board of Directors in its oversight of financial reporting practices and the quality and integrity of the financial reports of the Company, including compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualifications and independence, and the performance of the Company’s internal audit function. The Audit Committee appoints and is responsible for setting the compensation of the Company’s independent registered public accounting firm. In selecting the Company’s independent registered public accounting firm, the Audit Committee considers, among other things, historical and recent performance of the current independent audit firm, known significant legal or regulatory proceedings related to the firm, external data on audit quality and performance, industry experience, firm capabilities and audit approach, and the independence of the audit firm. The Committee reviews the firm’s qualifications on an annual basis, assessing, among other things, the quality of its service, the quality of the communication and interaction with the firm, and the firm’s independence, objectivity and professional skepticism. In conducting this review, the Committee also considers the advisability and potential impact of selecting a different independent public accounting firm.

The Audit Committee also provides oversight of the Company’s internal audit function including the review of proposed audit plans and the coordination of such plans with the Company’s independent registered public accounting firm. The Audit Committee oversees the adequacy and effectiveness of the Company’s accounting and financial controls and the guidelines and policies that govern the process

|

|

PROPOSAL 1—ELECTION OF DIRECTORS

Report of the Audit Committee

by which the Company undertakes financial, accounting and audit risk assessment and risk management. The Audit Committee also is responsible for reviewing compliance with the Company’s Ethics Policy and assuring appropriate disclosure of any waiver of or change in the Ethics Policy for executive officers, and for reviewing the Ethics Policy on a regular basis and proposing or adopting additions or amendments to the Ethics Policy as appropriate. In connection with the Ethics Policy, the Audit Committee has established procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting controls or auditing matters and the confidential, anonymous submission by employees of the Company of any accounting or auditing concerns. The Audit Committee operates under a formal written charter that has been adopted by the Board of Directors.

The Audit Committee members are not professional accountants or auditors, and their role is not intended to duplicate or certify the activities of management and the independent registered public accounting firm, nor can the Committee certify that the independent registered public accounting firm is “independent” under applicable rules. The Committee serves a Board-level oversight role, in which it provides advice, counsel and direction to management and the independent registered public accounting firm on the basis of the information it receives, discussions with management and the independent registered public accounting firm, and the experience of the Committee’s members in business, financial and accounting matters.

During fiscal years 2016 and 2017, the Company’s independent registered public accounting firm for each of those years, Ernst & Young LLP (“EY”), billed the Company the following fees and expenses:

| 2016 | 2017 | |||||||

Audit Fees(1) | $3,900,000 | $3,148,180 | ||||||

Audit-Related Fees(2) | $ 660,000 | $ 205,000 | ||||||

Audit-Related Fees –Spin-off(2) | $2,195,000 | $1,222,634 | ||||||

Audit-Related Fees - Total(2) | $2,855,000 | $1,427,634 | ||||||

Tax Fees(3) | $ 183,000 | $ 180,000 | ||||||

All Other Fees(4) | $ 0 | $ 0 | ||||||

Total(5) | $6,938,000 | $4,755,814 | ||||||

The Audit Committee has adopted a policy for thepre-approval of services provided by the Company’s independent registered public accounting firm. Under the policy, particular services or categories of services have beenpre-approved, subject to a specific budget. Periodically, but at least annually, the Audit Committee reviews and approves the list ofpre-approved services and the maximum threshold cost of performance of each. The Audit Committee is provided with a status update on all EY services periodically throughout the year and discusses such services with management and EY. Pursuant to itspre-approval policy, the Audit Committee has delegatedpre-approval authority for services provided by EY to its Chair, Bruce P. Nolop. Mr. Nolop maypre-approve up to $100,000 in services provided by EY, in the aggregate at any one time, without consultation with the full Audit Committee, provided he reports such approved items to the Audit Committee at its next scheduled meeting. In determining whether a service may be provided pursuant to thepre-approval policy, consideration is given to whether the proposed service would impair the independence of the independent registered public accounting firm.

In connection with its review of the Company’s 2017 audited financial statements, the Audit Committee received from EY written disclosures and a letter regarding EY’s independence in accordance with applicable requirements of the Public Company Accounting Oversight Board, including a detailed statement of any relationships between EY and the Company that might bear on EY’s independence, and has discussed with EY its independence. The Audit Committee considered whether the provision ofnon-audit services by EY is compatible with maintaining EY’s independence. EY stated that it believes it is in full compliance with all of the

|

|

PROPOSAL 1—ELECTION OF DIRECTORS

Report of the Audit Committee

independence standards established by the various regulatory bodies. The Audit Committee also discussed with EY various matters required to be discussed by Statements on Auditing Standards No. 16, as amended (AICPA, Professional Standards, Vol. 1, AU Section 380), as adopted by the PCAOB in Rule 3200T, including, but not limited to, the selection of and changes in the Company’s significant accounting policies, the basis for management’s accounting estimates, EY’s conclusions regarding the reasonableness of those estimates, and the disclosures included in the financial statements.

The Audit Committee met with management, the Company’s internal auditors and representatives of EY to review and discuss the Company’s audited financial statements for the fiscal year ended December 31, 2017. Based on such review and discussion, and based on the Audit Committee’s reviews and discussions with EY regarding the various matters mentioned in the preceding paragraph, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’sForm 10-K for the 2017 fiscal year, and the Board has approved that recommendation.

Audit Committee

The Audit Committee assists the Board of Directors in its oversight of financial reporting practices and the quality and integrity of the financial reports of the Company, including compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualifications and independence, and the performance of the Company’s internal audit function. The Audit Committee appoints and is responsible for setting the compensation of the Company’s independent registered public accounting firm. The Audit Committee reviews the Company’s independent registered public accounting firm’s qualification, performance and independence on an annual basis.

The Audit Committee also provides oversight of the Company’s internal audit function and oversees the adequacy and effectiveness of the Company’s accounting and financial controls and the guidelines and policies that govern the process by which the Company undertakes financial, accounting and audit risk assessment and risk management. In connection with the Ethics Policy, the Audit Committee has established procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting controls or auditing matters and the confidential, anonymous submission by employees of the Company of any accounting or auditing concerns. In addition, the Committee monitors the Company’s finance- and investment-related diversity and inclusion efforts, including the Company’s investment, procurement and purchasing involving minority-owned businesses.

The Audit Committee members are not professional accountants or auditors, and their role is not intended to duplicate or certify the activities of management and the independent registered public accounting firm, nor can the Committee certify that the independent registered public accounting firm is “independent” under applicable rules.

The Board has determined that each of Bruce P. Nolop, ChairStuart J. Epstein and Karen H. Grimes is an audit committee financial expert, as that term is defined under SEC rules, and is independent, as defined in the NYSE listing rules.

Marjorie MagnerExecutive Committee

Susan NessThe Executive Committee may exercise the authority of the Board between Board meetings, except as limited by Delaware law. In 2021, the full board was able to review all items requiring Board oversight or approval and did not require the Executive Committee to act in its stead.

|

8 | | 2022 PROXY STATEMENT |

| Proposal 1—Election of Directors: Committees of the Board of Directors |

Leadership Development and Compensation Committee

As further described in the “Compensation Discussion and Analysis” (CD&A) section of this Proxy Statement, the Leadership Development and Compensation Committee discharges the Board’s responsibilities relating to the compensation of the Company’s executives and has overall responsibility for the Company’s compensation plans, principles and programs. The Committee also monitors the Company’s human resources practices, including its performance in diversity, inclusion and equal employment opportunity, and supports the Company’s commitment to diversity and inclusion and the continuation of the Company’s successful efforts to gain and maintain diversity among its employees and management.

Under its charter, the Committee may, in its sole discretion, engage, retain and compensate any compensation consultant, independent legal counsel or other adviser it deems necessary. In selecting a consultant, counsel or adviser, the Committee evaluates its independence by considering the independence factors set forth in applicable SEC and NYSE rules and any other factors the Committee deems relevant to the adviser’s independence from management.

The Committee retains Meridian Compensation Partners, LLC (Meridian) as its consultant to advise it on executive compensation matters. The Committee has determined that Meridian is an independent compensation consultant based on a review of the independence factors reviewed by the Committee.

Meridian participates in Committee meetings as requested by the chair of the Committee and communicates directly with the chair and other members of the Committee outside of meetings. Meridian specifically has provided the following services to the Committee:

Consulted on various compensation plans, policies and practices;

Participated in Committee executive sessions without management present;

Assisted in analyzing executive compensation practices and trends and other compensation-related matters;

Consulted with management and the Committee regarding market data used as a reference for pay decisions;

Consulted on the structure of the equity award program; and

Reviewed the CD&A and other compensation related disclosures contained in this Proxy Statement.

Nominating and Governance Committee

The Nominating and Governance Committee regularly monitors the composition of the Board to ensure that it has the necessary mix of skills and experience to support the Company’s strategic focus, including diversity of thought, age, experience and racial, ethnic, and gender diversity. The Committee is charged with identifying individuals qualified to become Board members, recommending to the Board candidates for election or re-election to the Board, and considering from time to time the Board committee structure and makeup. The Committee also monitors and takes a leadership role with respect to the Company’s corporate governance practices.

The Nominating and Governance Committee charter sets forth certain criteria for the Committee to consider in evaluating potential director nominees. In addition to evaluating a potential director’s independence, the Committee considers whether director candidates have relevant experience and skills to assure that the Board has the necessary breadth and depth to perform its oversight function effectively. The charter also encourages the Committee to work to maintain a board that reflects the diversity, in terms of gender, age, race, ethnicity and other self-identified diversity attributes of the communities the Company serves, and to support that goal through appropriate board-level self-assessment, nomination and recruitment processes. The Committee evaluates potential candidates against these requirements and objectives. For those director candidates who appear upon first consideration to meet the Committee’s criteria, the Committee will engage in further research to evaluate their candidacy.

The Nominating and Governance Committee periodically retains search firms to assist in the identification of potential director nominee candidates based on criteria specified by the Committee and in evaluating and pursuing individual candidates at the direction of the Committee. The Committee will also consider timely written suggestions from shareholders. Shareholders wishing to suggest a candidate for director nomination for the 2023 Annual Meeting should mail their suggestions to TEGNA

| 2022 PROXY STATEMENT | | | 9 |

| Proposal 1—Election of Directors: Committee Charters |

Inc., 8350 Broad Street, Suite 2000, Tysons, Virginia 22102, Attn: Secretary. Suggestions must be received by the Secretary of the Company no earlier than February 21, 2023 and no later than March 13, 2023. The manner in which the Committee evaluates director nominee candidates suggested by shareholders will be consistent with the manner in which the Committee evaluates candidates recommended by other sources.